(Without Getting in Trouble or Running Out of Cash)

One of the first questions every new business owner eventually asks is:

“How do I actually pay myself?”

It’s a simple question—but the answer depends on how your business is set up. And if you get it wrong, you could mess up your taxes, short your cash flow, or draw red flags from the IRS.

Here’s a quick guide to paying yourself the right way from day one.

🔹 1. Know Your Business Structure

How you pay yourself depends on your legal setup:

- Sole Proprietorship or Single-Member LLC:

You don’t get a paycheck. You simply take an “owner’s draw” by transferring money from the business account to your personal account. You’ll pay taxes on the profits of the business—not just what you take out. - Multi-Member LLC or Partnership:

Similar to the above, but you’ll split profits according to your ownership share. Again, draws are not “wages.” - S-Corp or C-Corp:

You must pay yourself a reasonable salary as an employee—yes, with payroll taxes. Then, if there are extra profits, you can also take distributions (which are often taxed at a lower rate).

🔹 2. Don’t Just Transfer Random Amounts

Even if you’re a sole prop, don’t treat your business account like an ATM.

Instead:

- Set a regular draw schedule (weekly or monthly)

- Use bookkeeping to see how much your business can actually afford

- Keep money aside for taxes—at least 20–30% of your profits

💡 Pro tip: Open a separate business savings account and move tax money there monthly. Future-you will thank you.

🔹 3. Keep it Legal with Payroll (if you’re an S-Corp)

If your business is structured as an S Corporation, the IRS expects you to:

- Run official payroll

- Withhold and pay employment taxes

- File the appropriate forms (like 941s and W-2s)

Trying to skip this step and only take distributions is one of the fastest ways to trigger an audit.

🔹 4. How Much Should You Pay Yourself?

This part trips up a lot of new business owners. Pay yourself too little, and you’ll burn out. Pay yourself too much, and you might starve your business—or get hit with tax penalties.

Here’s how to find the sweet spot:

- Start with a baseline budget:

What’s the minimum you need to cover your personal living expenses? That’s your target starting point—not your “dream salary” just yet. - Check your business cash flow:

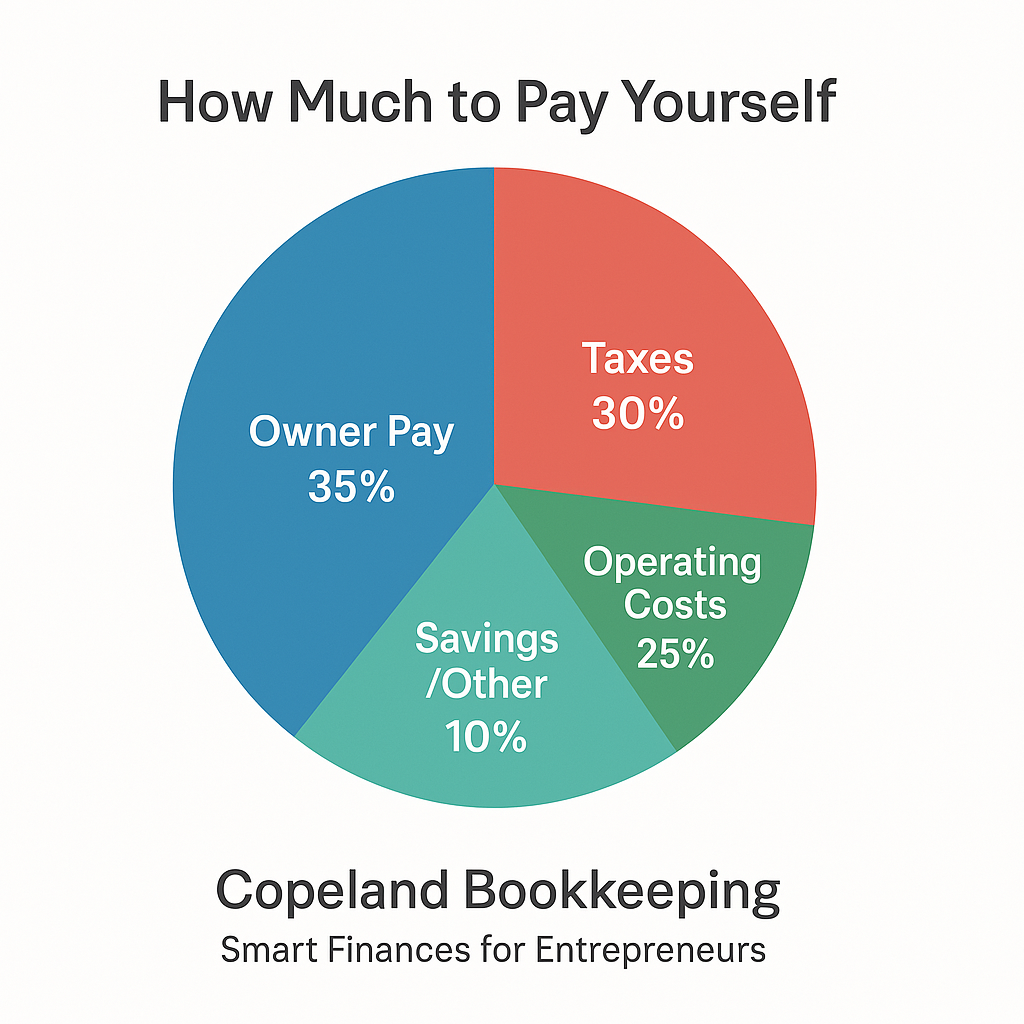

Your business should be able to afford your pay after covering all operating costs and setting aside taxes. - Use a percentage rule if you’re unsure:

A common rule of thumb is to pay yourself 30–50% of your net profits (after expenses, before tax). As profits grow, you can increase your percentage. - For S-Corps:

The IRS wants your salary to be “reasonable” based on your role and industry. That doesn’t mean minimum wage—and it doesn’t mean six figures if your business isn’t there yet. Benchmarks or even a quick chat with a payroll pro can help.

🎯 The goal: Pay yourself sustainably—enough to live on, while leaving your business room to grow.

🔹 5. Track Everything

Whatever your setup, your draws or salary should be recorded properly in your books. If you’re using software like QuickBooks Online:

- Use an “Owner’s Draw” or “Owner’s Equity” account for transfers

- Use “Payroll Expense” for S-Corp wages

Clean records make tax time easier and help you get approved for loans, credit, or grants.

✅ TL;DR

- Sole Prop/LLC? Take draws.

- S-Corp? Pay yourself through payroll + optional distributions.

- Don’t just guess—pay yourself enough to live, but not so much it hurts your business.

- 30–50% of net profit is a solid starting point for most.

- Always separate business and personal accounts.

- Plan for taxes.

- Stay consistent.